Starting this year, there is a slight tweak in the process of claiming your tax refund. Let’s find out more.

From changes in ITR forms to making e-filing of IT returns mandatory, starting this year, the Income Tax department has introduced a slew of measures that will facilitate easy and hassle-free filing of IT returns for the average man. The IT department has also made a slight tweak in the process of claiming tax refunds. Let’s find out more.

Pre-Validate Your Bank Account:

Now if you want to claim a tax refund, you will have to pre-validate your banking account in which you want to receive the refund. You will receive your Income Tax refund once you’ve filed your return successfully filed or when you’re filing your Income Tax return.

Moreover, besides pre-validating your account, you will also need to link your PAN with your bank account. The Income Tax department has stated clearly that if you haven’t linked your PAN with your bank account, you won’t be able to get the tax refund in your bank account.

These new changes closely follow the Income Tax department’s announcement that from March 1, 2019, it will issue only e-refunds. The IT department will issue e-refunds only to those accounts that are linked with PAN and are also pre-validated on the Income Tax e-filing website i.e. https://www.incometax.gov.in/iec/foportal/

In case you haven’t linked your PAN to your bank account or have not registered your PAN, you can visit your nearest bank branch to do it.

Additional Reading: The Latest On PAN & Aadhaar Linking

How To Pre-Validate Your Bank Account:

Follow these steps to pre-validate your banking account:

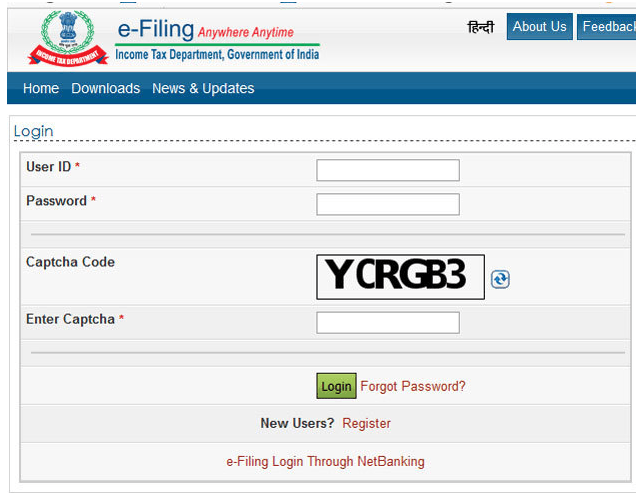

Step 1: Visit https://www.incometax.gov.in/iec/foportal/ and log in to your account. The User ID to enter your account is your PAN number.

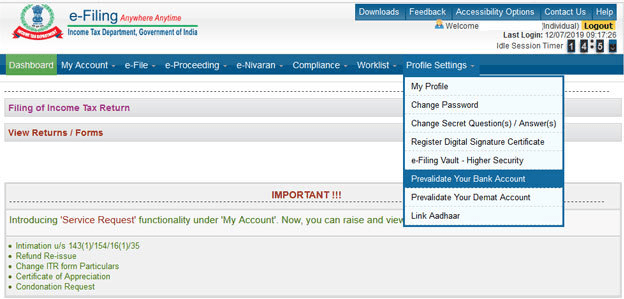

Step 2: Once you’ve logged in, click on the ‘Profile Settings’ tab in your account and then select ‘Pre-validate your bank account’ option.

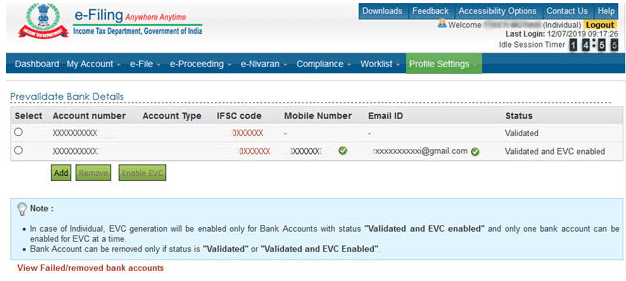

Step 3: If you already have an account/s that is pre-validated, they should show up here. If you want your tax refund to be credited to a different bank account or you don’t have a pre-validated bank account, then click on ‘Add’.

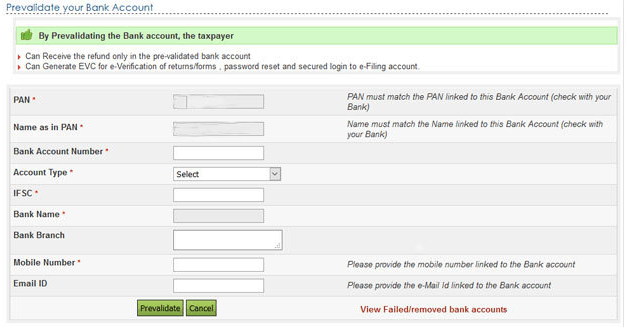

Step 4: On clicking ‘Add’, a new page will open and you will have to enter details like your bank account number, account type, IFSC Code, bank name, branch name, your mobile number and email ID.

The mobile number and email ID that you provide here have to match your bank records.

Step 5: Click on ‘Pre-validate’. Once you’ve clicked, this message will appear on your screen: “Your request for pre-validating bank account is submitted. Status of your request will be sent to your registered email ID and mobile number.”

Additional Reading: 5 Benefits Of Filing Income Tax Returns

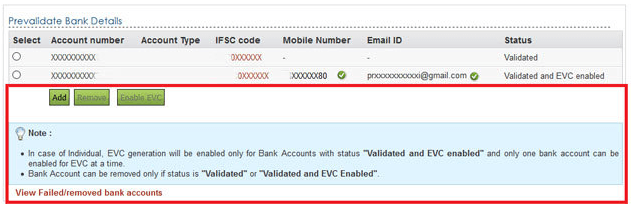

If you’ve followed these steps but aren’t sure if you have successfully pre-validated your bank account or not, you can check by logging in to your account on the e-filing website under the ‘Profile settings’ option. In case you wish to remove a particular bank account from your e-filing account, then in the ‘Pre-validate your bank account’ option under the ‘Profile settings’ tab, select the account you want to remove and click on ‘Remove’ option.

If you want to view the list of bank accounts where pre-validation has failed, then you can do the same by clicking, ‘View Failed/removed bank accounts’. It will also show you all the details of bank accounts and the reason for rejection or removal.

Planning to save taxes? You could invest in Fixed Deposits where interest rates go as high as 8.65%.