Gold – Pros and Cons!

There is a famous saying “A friend in need is friend indeed”. If we talk in financial terms this statement can be rephrased as “A financial asset in need is a financial asset indeed”. Normally every individual investor builds a portfolio using a lot of financial assets but is he aware which option in the… Read More »

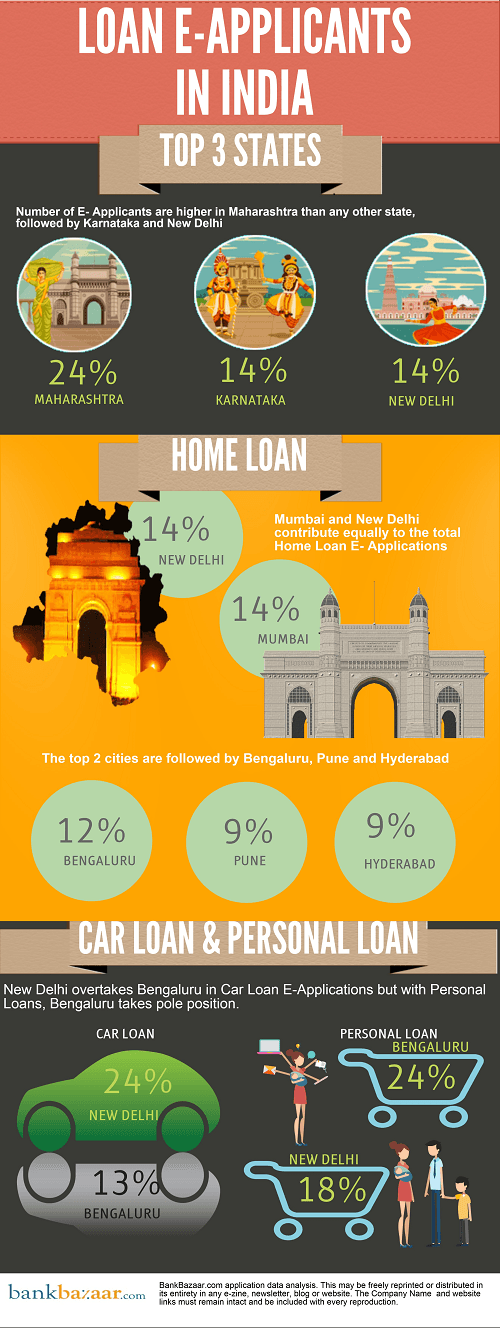

How to increase your home loan eligibility!

While looking for the right home loan to buy a dream house one may come across a situation when the total amount that one is eligible for is insufficient. It is such situations that one needs to work out ways and means to increase the total eligible amount in order to be able to acquire… Read More »

7 golden ways to beat inflation woes!

The situation in most Indian households and corporate offices today shows one major action taken – cost-cutting. This action is attributed to the inflation rates in India as well as the looming global recession. Inflation is defined as a sustained increase in the general level of prices for goods and services.

Tax evasion and its implications!

Individuals have the freedom to self assess income and pay taxes. That doesn’t mean that if you do not declare a particular stream of income to evade taxes, you will go scot free! Tax evasion is an illegal activity which entails not filing income tax returns altogether or misrepresenting the tax payable amount. It is… Read More »

How to maintain a good Credit History?

You must be aware of loan and credit card applications getting rejected due to bad credit history or a lesser credit score. But have you ever wondered as to what contributes to building your credit score? What are the ways that can help you in establishing and maintaining a worthy credit report? We always think… Read More »

Tips to invest!

The known remedy to make capital surpass inflation is to invest in equity instruments. This helps investor grow their capital much faster and will help beat inflation in spite of sharp periods of decline. Equity investment refers to the buying and holding of shares of stock on a stock market by individuals and funds in… Read More »

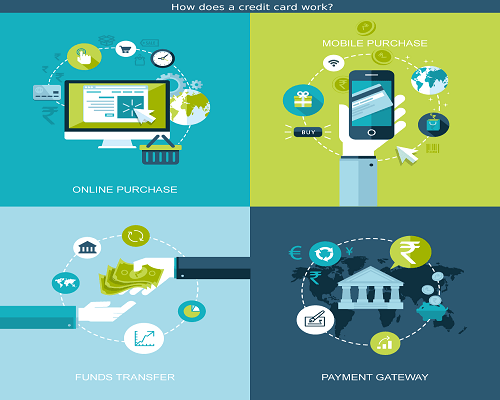

How a Credit Card works?

Credit Cards are a part of our everyday life. We use plastic money to pay for our groceries, utility bills, shopping and many more. But have you ever wondered how a credit card actually works? What happens in those fractions of seconds when you swipe your card? How the money does reach merchant? And how… Read More »

RBI eases lending norms – Good news for home buyers!

In just a few days following the budget RBI has paved the path for increasing the liquidity for banks, enabling the possibility of a lot of positive steps in the real estate sector. Impact on home buyers RBI notified to consider the home loan up to Rs 50 Lac (i.e. a property value up to… Read More »

Manage your credit card!

A credit card is a useful tool, when managed judiciously but a lurking danger if you mismanage it. One of the first things you need to keep in mind, is read the term and conditions when you apply for a credit card. It could be a laborious process but something that has to be dealt… Read More »