*Trigger warning for shopaholics*

Dear readers, gather ’round, and let me take you on a journey through the aisles of online shopping, where the siren call of “Add to Cart” beckons even the most frugal souls. Yes, we’re diving into the realm of impulse buying and I promise you, it’s eerily irresistible.

The Allure of Online Shopping

Picture this: You’re in your pyjamas, nestled in the cosy cocoon of your favourite blanket, a steaming cup of cocoa in hand and your laptop screen illuminating your eager face. You innocently open your web browser, intending to buy just a single item—a humble book, perhaps. But before you know it, you’ve fallen into a shopping vortex, where you’re haunted by irresistible deals, discounts and a seemingly endless array of products. It’s like being lured into an eerie, online retail haunted house.

Online shopping portals – the modern-day Pandora’s box – is designed to be irresistible. They know what you like, what you’ve bought before and what you’re likely to purchase next. But beware, for this convenience is a double-edged sword. They bombard you with suggestions, drawing you deeper into the abyss. It’s almost as if they have employed some kind of digital sorcery to read your mind.

The Allure of One-Click Check Out

With a click here and a click there, the ghosts of one-click shopping haunt our wallets. It’s all so easy. You see a product you like and before you know it, it’s on its way to your doorstep. But remember, what’s easy on your fingers can be a real scare for your finances. Don’t let the ghost of “FOMO” (Fear of Missing Out) possess you!

The Allure of Impulse Buying

Let’s explore the intriguing realm of impulse buying. It’s as if mischievous little entities sneak into your shopping cart, slyly introducing products you never knew you needed. It starts innocently enough. You click on a product you’re genuinely interested in and suddenly, a pop-up suggests, “People who bought this also bought…”, and just like that, your cart fills up with items you never knew you couldn’t live without.

Often, you might find yourself pondering, “Do I really need this Jimi Hendrix wig for my cat?” or “Is a 24-pack of rainbow-colored brush pens an essential part of adulting?” The answer is probably no, but your mind has a way of making you think otherwise.

The Ghosts of Budgets Past

One of the scariest aspects of online shopping is the ghostly reappearance of past purchases. You think you’ve put a product to rest in your purchase history, but the website has other plans. It continues to haunt you with reminders of your previous shopping sprees, almost taunting, “Remember how happy these things made you? Want more of that?”

These digital apparitions can make you feel like Scrooge being visited by the ghosts of Christmas past.

The Haunting Regret of Buyer’s Remorse

Impulse buying often leads to buyer’s remorse and that’s a ghost that lingers. You’ve unboxed your latest purchase and suddenly, it doesn’t seem as magical as it did on the screen. That’s when the eerie realisation sets in – you’ve spent your hard-earned money on something you truly didn’t want or need.

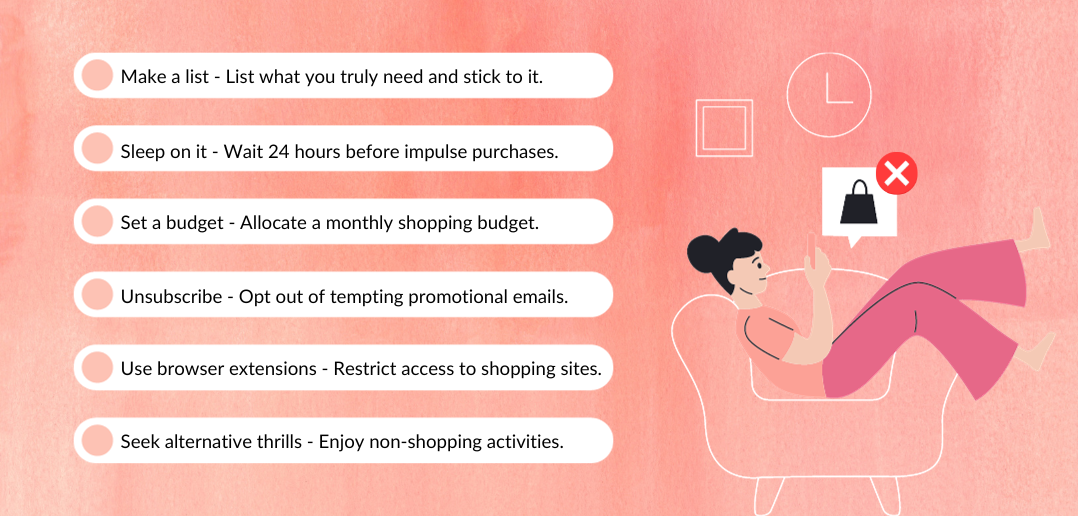

Here are some tricks to help you avoid falling under their spell:

- Make a list: Before you start browsing, make a list of what you actually need. Stick to it as if your financial future depends on it (because it does).

- Sleep on it: If you see something that tickles your fancy, wait for at least 24 hours before making the purchase. This will help you separate genuine desires from fleeting impulses. Use that “Save for Later” option effectively.

- Set a budget: Allocate a specific amount of money for online shopping each month. Once it’s gone, it’s gone.

Additional Reading: Franken-finance: Piecing Together A Budget That Won’t Scare You!

- Unsubscribe from promotional emails: Those emails are like siren calls. Unsubscribe and save yourself from temptation.

- Use browser extensions: There are browser extensions that can block or limit your access to shopping websites during certain times. They’re like the digital equivalent of garlic to vampires.

- Seek alternative thrills: Find other activities that bring you joy and satisfaction. A good book, a long drive or even a cooking experiment can offer fulfilment without the aftertaste of buyer’s remorse.

The Ghostbusters of Impulse-Buying

Credit Cards, with their purchasing power, can be your secret weapon against impulse buying. They can help you tame the allure of online shopping. Here’s how:

- Card Controls: Card controls are an invaluable feature for bolstering your financial security and maintaining strict control over your spending. They enable you to tailor your Credit Card usage to your precise needs by restricting card usage to specific types of merchants and setting transaction limits.

- Statement Review: Credit Card statements reflect your shopping choices. Regularly reviewing your statements helps you track your spending and identify those impulsive purchases.

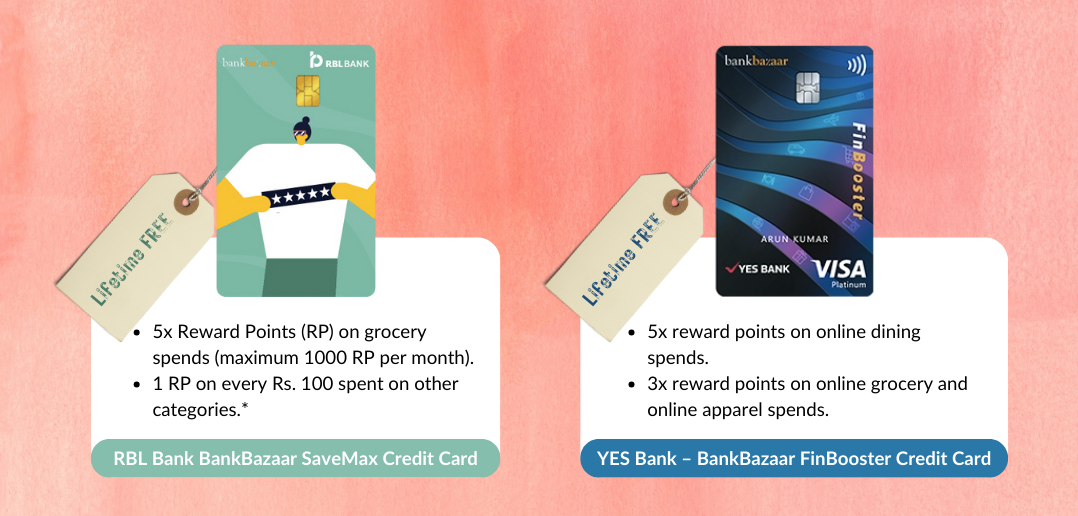

- Rewards and Cashback: Some Credit Cards offer cashback, rewards or discounts on specific purchases. These incentives can be a motivating factor to make planned, mindful purchases instead of falling into the impulse-buying trap.

Additional Reading: 7 Lesser-Known Perks Of Credit Cards

- Emergency Fund: Credit Cards can be your financial lifeline during emergencies. By saving your card for these critical situations, you’ll be less tempted to use it for frivolous online shopping escapades.

- Responsible Spending: Building a positive credit history and maintaining a good Credit Score require responsible spending. This means using your Credit Card wisely and paying your bills on time, which can deter you from impulsive purchases.

- Expense Calculator: Use a mobile app to track and categorise your spends every month. When you see just how much those tiny impulse online purchases add up to, you will learn to spend more judiciously.

The Hauntingly Good Ending

In the eerie-sistible world of online shopping, impulse buying can be a formidable adversary. It tempts you with phantom sale prices, ghostly algorithms and the comfort of retail therapy. But, armed with the right knowledge and strategies, you can exorcise these spending demons from your life.

In conclusion, Credit Cards, when used wisely, can be your ghostbusters, helping you maintain control over your spending and ward off impulse-buying demons. So, the next time you find yourself navigating the eerie aisles of online shopping, remember the power of your trusty Credit Card and slay those temptation monsters. It’s your money, your choices – the power to haunt or be haunted lies firmly in your hands.

Happy shopping, fellow hunters of great deals! May your online carts be forever free of impulse purchases!