Let’s look at seven common things that people do when it comes to money, which stops them from achieving their financial goals.

Wise old men and women, mystics and motivational speakers, all say one thing – think positive and good things will happen to you. Is it true? Can you turn your life around just by thinking about the changes you want to see? Well, we don’t know if that’s possible or not but we know one thing for sure; your thoughts determine your actions. If that’s the case, then thinking positively could lead to the desired results in your life.

With that established, let’s discuss the different money mindsets people hold. What according to you is the nature of money? Is it elusive, is it something you will never be able to acquire or is it something you don’t worry about? If we are to go by the logic explained in the first para, your opinion on the nature of money is a direct reflection of your mindset about money. If you think money is elusive, it will elude you; if you think money is your friend, you will, perhaps, never run out of it.

Unfortunately, there are only a handful of people who think positively about money. The rest are always worried sick about losing it. This to the extent that they don’t even make investments out of fear of losing it all. Sigh! We have found seven common things that people do when it comes to money which stops them from achieving their financial goals. Let’s see how we can turn this around.

Additional Reading: Simple Money Management Hacks

-

Learn To Take Your Own Financial Decisions

Brainstorming financial dilemmas with your friends and family is a good habit, but allowing them to make decisions about your money might not be the best idea. It’s wiser to get insights from the experienced before taking a financial decision, but the final call should be yours.

It often happens that when we find ourselves in a financial fix, similar to what our trusted family members and friends have faced, we uninhibitedly take the road they’ve taken. This might work in some cases, but not always.

When facing a problem, financial or personal, always evaluate it independently. The same problem is actually never the same for two people. Explore your options and pick the solution that best solves your problem, even if the route you must take is different from what your family and friends have taken.

But you don’t have to be a rebel all the time. Be open to change if a trusted person comes up with a better solution than the one you have thought of. Don’t confuse arrogance with intelligence.

-

Let Go

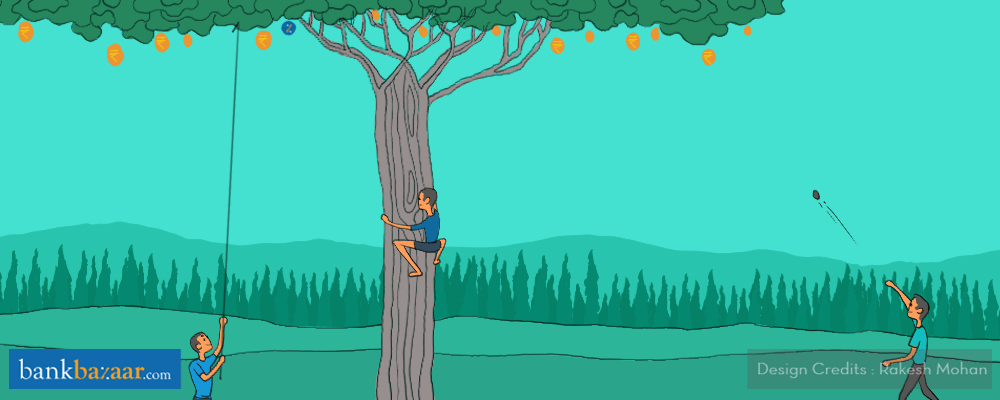

Many people think that clinging tightly to their money will keep them safe. But money doesn’t like hugs and cuddles. Think of money as a free-spirited person. Let it soar, not by spending it frivolously, but by investing in smart investment schemes. By holding your money close to you, you are inhibiting its growth.

If you are really scared of letting go then start with the safest of investment options. Nobody is going to judge you if you don’t invest in the stock market. Start by opening a Fixed Deposit account. Your investing acumen will improve with time and you’ll learn to take slightly more risky albeit calculated risks. Think of small-cap Mutual Funds or Balanced Equity Funds.

Don’t keep your money stashed in your cupboard. Your cupboard money won’t be worth much in a fight with inflation, which has a track record of only moving in an upward direction.

-

Find Your Balance

Having a balanced outlook is a good thing. Similarly, when it comes to investing, try to avoid both investing excessively and not investing at all. Instead, look for middle ground.

Good financial planning does not mean murdering your present in cold blood for a happy (anticipated) tomorrow. It is learning to strike a balance between today and tomorrow. Smart investment is not about paying big premiums, it’s drawing the most you can from every penny you invest. The compounding effect will make your small investments big overtime. For that, you don’t need to shrink your monthly budget to the size of a pea. Keep a liberal amount of money at hand. Go on holidays, watch movies, and splurge once in a while (it’s not the same as overspending). It’s ok to do so. A happy person will make better financial decisions than an unhappy one. Which one are you?

-

Do Not Blame The Money

Don’t blame the amount of money that comes in if you’re finding it hard to meet your goals. We’re not saying that having more money won’t ease things along, but take a look at your financial habits to. Keep a track of what’s going out. Reflect on your financial habits and fix that which is out of order.

-

Do Not View Yourself In The Light Of Others

Do not think that if you come from a financially humble background, you’ll always remain there. Or that if you were born with a silver spoon in your mouth, it will stay there forever. We are all familiar with rags to riches stories and vice versa. No matter what your financial status is, you can change it for the better with a blend of hard work and smart work. On the contrary, good financial standing, too, can be lost if it is not given the optimum dose of investments and savings. If you wish to add stars to your financial well-being then you must look beyond the obvious and mundane for a solution. But at no cost believe that you are doomed to a life without money.

-

Did You Break-Up With Money? Don’t Be Too Harsh On Yourself

We understand that no matter what you do, concerns about money will get the better of you now and then. You know motivating words work like magic on dispirited individuals. Then why not learn the art of self-motivation for times when you feel like you are losing the battle. Don’t sulk if at some point you see your money management plans failing. Speak to yourself about a bright financial future and take precautionary measures.

You don’t always have to wait for hell to break lose to motivate yourself. While you journey to a rich financial future, give yourself little treats on way for achieving important milestones. This will keep you from straying away from the desired path.

-

Do Not Love Money Blindly

Money is such a darling that you cannot help but fall in love with it. But loving money blindly will not do you much good. Money is essential to live a happy and content life, but making these bits of paper the centre of your life will play havoc with other aspects of it. When people say, ‘money is the root of all evil’ they are talking about a blind affair with money. Some people fall in so madly in love with money that they resort to wrongdoings to acquire it. Such actions often result in harmful reactions. Don’t scramble to acquire money, understand it. Once you do, money will come to you of its own accord. Let the blind chase end.

Additional Reading: Financial Planning Ideas To Make Your Money Grow

Once you understand that worrying about money will take you nowhere, you’ll find your mindset towards money changing automatically (for the better). There is no harm in loving and desiring money, but don’t obsess over it. It’ll take you nowhere. Moreover, a happy and peaceful mind can think up better financial strategies than an overworked one.

Allow us to introduce you to Credit Cards to help you unlock the hidden potential of your money.