You must be aware of loan and credit card applications getting rejected due to bad credit history or a lesser credit score. But have you ever wondered as to what contributes to building your credit score? What are the ways that can help you in establishing and maintaining a worthy credit report? We always think that just repaying your loans in time leads to a good credit score. And are unaware that there can be lot of other reasons also that impact our credit history. Let us read through all the factors that affect our credit history and tips to maintain a healthy credit record.

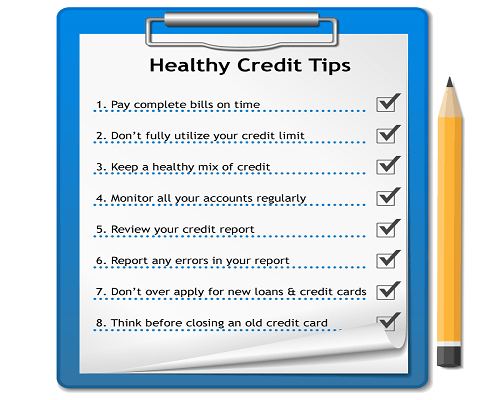

Pay Complete Bills on Time:

One of the best ways to maintain a healthy credit report is to inculcate self-discipline in terms of prompt payment of your credit card dues. You should always pay your credit card balance in full, as, revolving the credit to next month always attract additional cost and it may become difficult for you to manage this debt at some point of time. Paying your credit card dues regularly helps in boosting your credit score whereas a delay in payment shows up in your credit report as DPD (Delay in Payment Days) and is generally viewed negatively by the lenders. A credit score is dependent on several factors, classifying the repayment history as the most crucial factor. So, if you regularly make payment of all your credit card dues and EMIs on your loan, it definitely improves your credit score over time whereas a delay in payment negatively affects your credit score as well as your credit history.

Don’t fully utilize your credit limit:

You should avoid reaching the maximum credit limit on your credit card. The more you use your limit, the negative it is for your credit score. Although there is no thumb rule, but still most Financial Experts believe that it is safe to use up to 50% of the sanctioned limit on your credit card. For example: If you have a credit limit of Rs. 1,00,000, then your monthly credit card statement balance should not exceed Rs.50,000. Remember, whenever you use your credit card, you are borrowing money from a credit card company. So, using a lesser credit limit implies that you are financially secure and are not reliant on borrowings.

Keep a Healthy mix of Credit:

Ideally, a borrower should have a mixture of credit in terms of both secured as well as unsecured loans. Secured borrowings include loans like Home Loan, Car loan etc. whereas unsecured borrowings include Personal Loan, Credit Card etc. Most of the loan providers believe that a borrower’s risk of default increases if he/ she is exposed to more number of unsecured loans. Whereas, they feel more assured to lend secured loans. This is another reason why unsecured loans are more expensive than secured loans. Moreover, having different kinds of accounts (i.e. loans) is favorable because it shows that you have experience managing a mix of credit. The ideal credit history should contain a mix of a home loan, car loan and a couple of credit cards.

Monitor all your accounts regularly:

You should keep a check on all your repayments and ensure time payment for all the loans as well as credit cards wherein you were an applicant, a co-applicant or a Guarantor. A default in a loan wherein you were a guarantor, can equally ruin your credit history as that of an applicant. As a guarantor or co-applicant, you are held equally liable for missed payments. This is extremely important because your joint holder’s negligence could affect your ability to access credit when you need it.

Review your credit report:

Your credit card providers always share details of your repayment with several credit agencies like CIBIL TransUnion, Equifax etc. who in turn rate you on a credit score ranging from 300-900. It is a good practice to buy your credit score and complete report, at least once in a year to keep track of your credit history. Your credit score tells the lender how likely you are to pay back loan or credit card dues based on your past repayment behavior. The higher your score, more the chance of your loan application getting approved! If you know your credit score, you can always work towards improving it over a period of time.

Report any errors in your credit report:

Even if you repay your debt timely, does not mean that you will get excellent credit score. Some errors like inaccurate late payment may pull your score down. And if you are a victim of Identity Theft or credit card fraud, it may show up in your credit report as an extra loan in your name and may even lead to a drop in your credit score. Reviewing your credit report frequently (at least once a year) may help you to check all your credit related information and take necessary measures to correct those inaccuracies (if any).

Don’t over-apply for new loans or credit cards:

Any new inquiries for loans or credit cards always reflect in your credit report. And too many inquiries may affect your credit score. It is taken negatively by the lenders as the borrower might appear as “Credit Hungry” and also indicates that the debt burden is likely to, or has increased and he/ she is less capable of honoring any additional debt. So, if you have made many applications for loans, or have recently been sanctioned a loan, a Loan provider is likely to view your application with caution.

Think before closing an old credit card:

Suppose you have a credit card which is 6-7 years old and you are not using that card today. But you have a good credit history on that card. Now if you close this card, then the card issuer will stop sending your payment history or details to the credit bureau. This may lead to drop in your credit score slightly. While over-used cards affect your credit score negatively, the un-used cards, on the other hand strengthen your credit history. It signifies that you have a specific sanction limit but you are not using it as you are financially secure and are not hungry for credit. So, if you can manage, it is advisable to retain your old credit cards even if you don’t use them anymore.