Category Archives: Your dream home

Personal Loan Or Top-up Loan- Which To Choose To Repay A Home Loan?

Let’s assume you took the plunge to get your home and took a Home Loan two summers ago. You’ve started repaying the loan EMIs but you have a sudden financial emergency and you’re going to be strapped for funds for the next few months. Would you take a Personal Loan, or a Top-up Loan on your Home Loan to help you through the crisis?

Let’s Talk Mortgage Loans

A Mortgage Loan is money advance given by a bank against your property. The property could be your house, a piece of land or any other form of personal or commercial real estate in your name. This makes it a secured loan, which means the lender can forfeit your property if you fail to repay the loan.

Things To Do When Unable To Pay Your Home Loan

Living In The Lap Of Luxury

All About Subvention Loans

Salman Khan must have been super relieved when the verdict was announced. And so were all of his die-hard fans. Suraj and Nikita, were just as relieved when a Subvention scheme swooped in to save their day! They were planning to buy an apartment in Delhi and they zeroed in on a property with a… Read More »

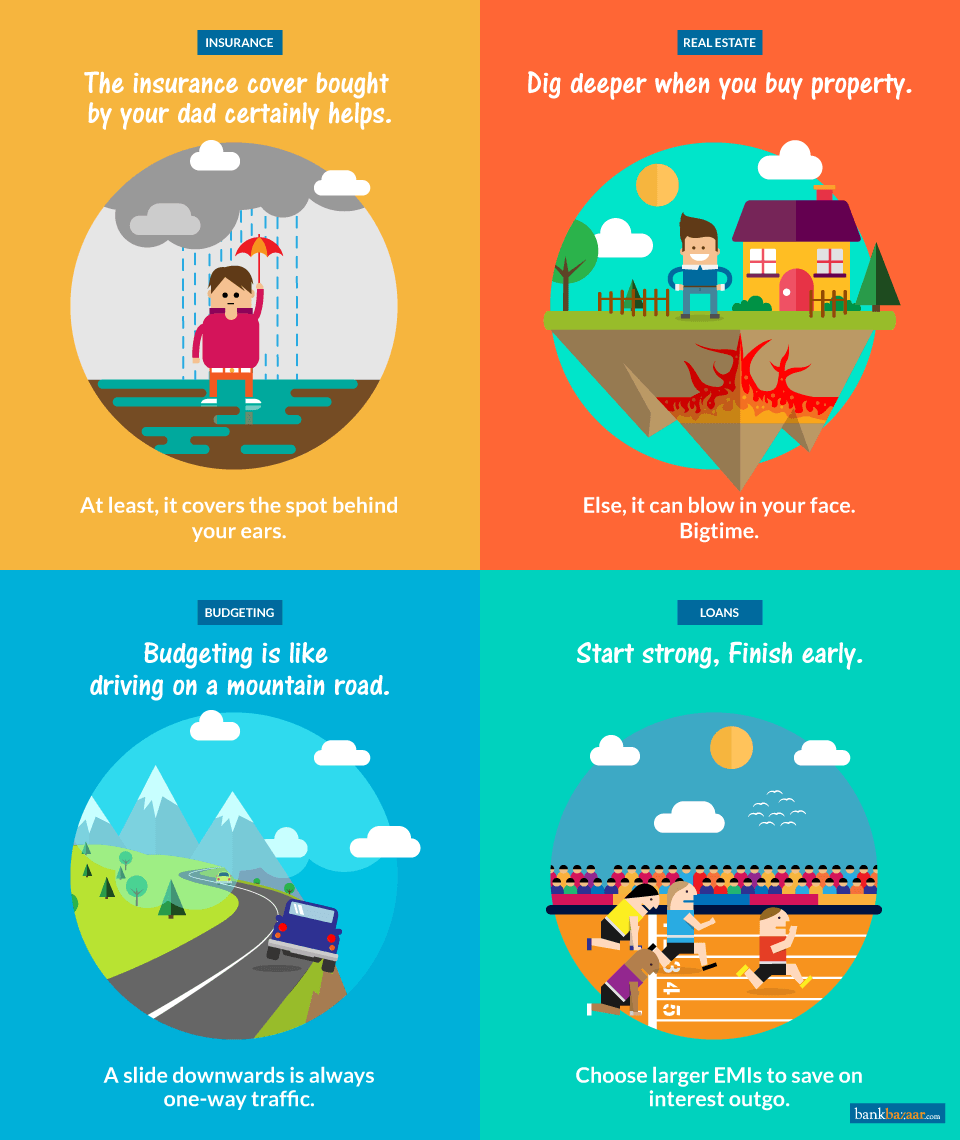

When It Comes To Financial Planning, Confucius Say…

Well, when we conversed with him, Mr. Confucius was confounded when confronted with the conundrum of Financial Planning. Confused? Let’s face it. It was a different world then. Insurance as a product probably didn’t exist (if you don’t count daylight robberies); so, checking your life insurance options was probably unheard of. Land was conquered, not bought using loans;… Read More »

5 Financial Planning Myths Busted

Sunny Leone was once a practicing nun. There! We just did what gets done all the time – create a myth. The financial planning world is full of such myths (not about Sunny Leone, but hey, we like the way you think!) Here are five such myths. We can’t tell you who created them. So… Read More »

Tax Implications on your Groovy Second Home

Humankind has spread its wings and made the moon its second home. While there are no tax implications of that (not yet at least!) there certainly are tax implications on your second home here on earth. We unlock the tax dreadlock for you. Tax implications for multiple properties Before getting into the details of tax… Read More »

10 tips for a smooth home buying experience!

Should I buy, should I not? Where will I get all the money from? How did my dad manage to buy one? What if I wait and the price goes up? Like it or not, these are some of the many questions that raid our mind every time we see one of those property ads… Read More »