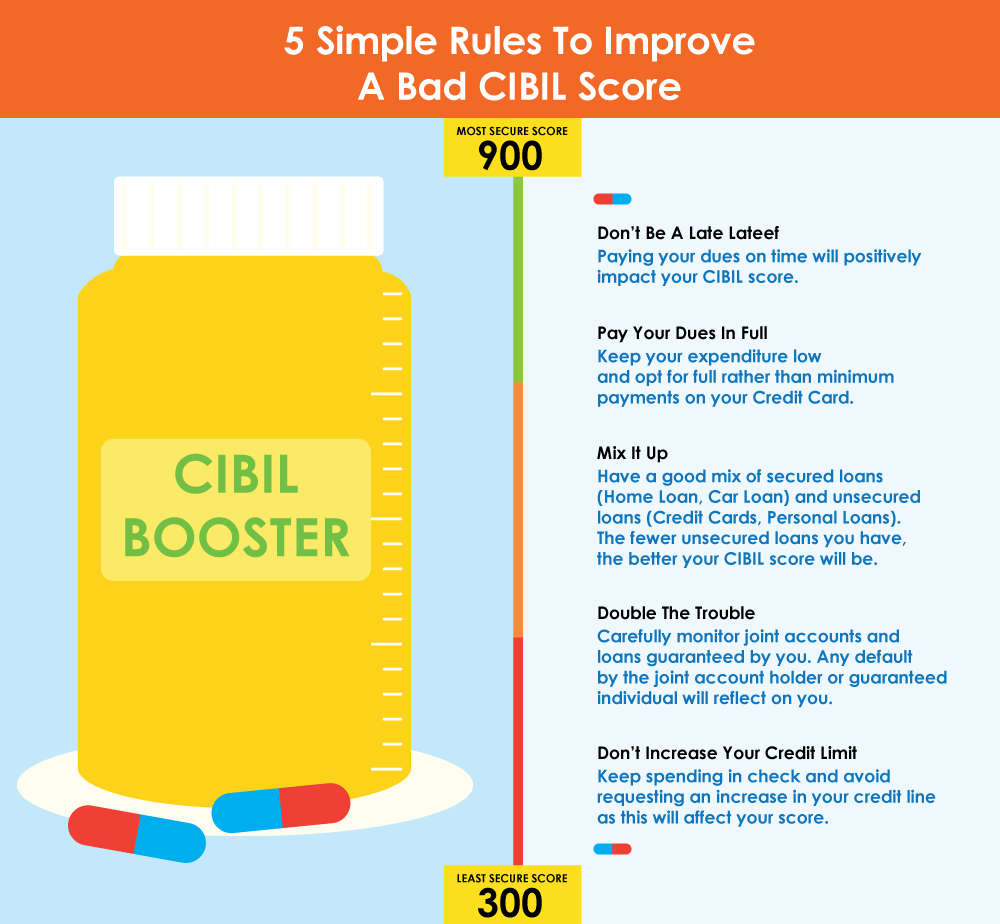

The first thing that determines your eligibility for any kind of loan is your Credit Score. A Credit Score is a three-digit numeric summary of your entire credit history which is prepared by CIBIL (Credit Information Bureau, India Limited) based on monthly information provided to CIBIL by banks and financial organisations. The CIBIL Score is allotted on a scale of 300 to 900. Scores closer to 900 indicate high credit trustworthiness and are likely to get a more favourable response from the credit institutions whereas a score close to 300 would indicate very low creditworthiness and are likely to be rejected. If you have a bad credit history and your Credit Score is low, your bank will directly reject your loan application. But, if you have a good Credit Score, your bank will immediately pass your loan application for further formalities. Given that your CIBIL score is the first and major deciding factor to help you get your loan application processed, it is very important to understand the factors that affect your score and take steps accordingly to improve it if it is below expectation.

Design Credits: BankBazaar