Tag Archives: life insurance

How Not To Go Wrong While Planning For Your Future Goals

Sameer wanted to plan for a Bangkok trip, but Sangeeta wanted to go somewhere within the country and save money. And, with those savings, she planned to buy gold jewellery which could have been considered as an investment for their future as well. To sort out their differences, the couple went to their uncle, who… Read More »

Tax Implications on Life Insurance

Whether you are planning on buying a house, embarking on a new career path or just drawing lines for your children’s future, this hoary advice rings your ears: “Do your best, but be prepared for the worst.” Of course, you have paid heed to it and that’s the reason why you have bought insurance policies. You… Read More »

Now find details of unclaimed money on insurer’s website!

When Nikita lost her husband to death, it was not only the grief of the unexpected mishap that shook her, but the huge debt trap of their home loan as well. Being a conventional house wife, Nikita has very little idea about Amit’s investments. This can be a common situation with not just conventional families,… Read More »

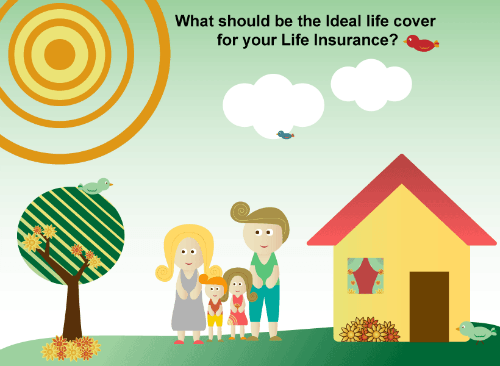

Facts to know before you lock your life insurance cover!

A Life Insurance policy ensures that your family is financially secure in your absence. It protects your family from financial distress or loss of income even if tomorrow you are no longer around to care for them. How much life cover should I take? The answer for this question lies in more questions- In my… Read More »

When is the best time to take a life insurance policy?

Most youngsters ignore life insurance mainly because of they feel, it’s not required for them. They take life insurance simply for the sake of tax deductions, and often feel neglect its benefits thinking it’s not for them. It’s quite natural for them to feel so, especially if they are away from familial responsibilities. But remember,… Read More »

Term Insurance – A necessity!

Understanding Term Insurance: Term Insurance is a plain life insurance plan. It is the simplest and most fundamental death benefit plan without any money back or maturity benefits. The Term insurance product is designed for a specified term (between 5-30 years) and provides benefit to the beneficiary if the policyholder dies during the covered term.… Read More »

Know life insurance variants!

When considering a life insurance policy with riders, make sure to understand the exclusions in the policy. For example, under Term Insurance, if the insured person commits suicide, whether sane or insane, within one year from the date of commencement of a term policy, the cover will become void, i.e. the nominee cannot claim the… Read More »

Tips to customize your insurance plan!

There cannot be a one size financial plan that fits all. Depending on one’s circumstances, income level, lifestyle and family, every person must plan for a customized financial planning. Life insurance is one such financial tool that offers customers the flexibility of a personalized design. Since each person has a different financial background and different… Read More »

LIC Direct from LIC

According to a recent press report Life Insurance Corporation of India, the traditional insurance company has launched Business vertical which is LIC Direct. Reports said that the added feature will allow the customers of the LIC to easily get access to their different plans and clarify their doubts. It is very Quick, Simple and Easy… Read More »